Suggestions

Domestic guarantee money might be a helpful tool to have releasing right up finance that would otherwise feel closed towards a low-income-producing house. not, they are not in place of its drawbacks.

For some group, their property is the most valuable resource. When you look at the Tx, an excellent homestead is protected against brand new says out-of loan providers but during the a not so many era. Thus, for many who fall behind towards the credit card money, otherwise lead to a serious car accident where injuries meet or exceed the insurance policies, you might be charged but you’ll maybe not beat your property. not, for individuals who get behind towards money toward a home guarantee loan there’s a very real exposure the lender commonly foreclose. Think carefully regarding if you truly need the cash, while so if or not an alternative types of borrowing is a great deal more suitable. Together with, try not to obtain over you prefer.

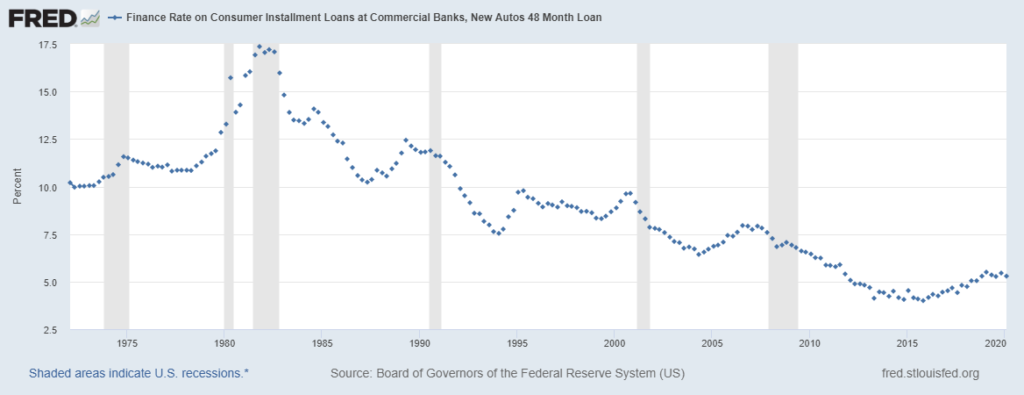

If you are rates into the house guarantee financing is all the way down than simply more style of finance, you still bear costs when it comes to attract and you can loan costs. You may also result in closing expenditures and document preparing fees. Ensure you know the way much the borrowed funds costs. (See the links in “Other Resources” going lower than to own aid in calculating such will set you back.)

Understand that you might only have one domestic guarantee mortgage toward your residence at the same time, you might merely have one house collateral financing per year, and you will a property collateral loan can not be transformed into a new kind of from financing. It is important to shop meticulously to find the best price, as you could possibly get later on realize that it is impossible or prohibitively-costly to create most other preparations if you like more funds or if you discover a far greater rate of interest.

Understand the time restrictions from the putting some financing, specifically if you have to have the cash of the a particular time. One situation we frequently select is that borrowers neglect to get a hold of upwards their closure statement the afternoon till the closure. Regrettably when that takes place, brand new closing need certainly to constantly be delay. Delays are not only awkward; capable including lead to improved costs into borrower in the event the a fee are energized to own re also-writing the borrowed funds data files or if perhaps the fresh new deadline tickets on the good positive interest secure.

- Understand the loan records meticulously just before closing to ensure they is actually right and that you know them. Never ever signal financing file when you have questions relating to the fresh new meaning of the provisions or if it contains blanks. Tx real estate laws can be very complex, so you may want a tx home lawyer review the new documents in order that they are correctly written and to resolve any queries you could have. More often than not such as for instance a scheduled appointment with a talented Texas actual estate lawyer shouldn’t wanted one or more otherwise a couple of hours out of billable day (a nominal rates as compared to other costs you will be paying), and may also help you end some unpleasant surprises within or after closing.

Finishing Responses

Needless to say, brand new Killeen home solicitors regarding Roberts & Roberts provides given legal advice regarding the family equity fund since they was basic recognized. We would be happy to plan an appointment to meet up with your when you have more questions about house security money, or if you need help within the reviewing your loan documents.

Roberts & Roberts, LLP

NOTICE: The site provides general details about Tx rules merely, and that’s maybe not a substitute for legal advice. As the result of for every instance hinges on the particular activities inside, we encourage one to consult an authorized attorneys before you take any action that apply to their rights.

- New lender’s liberties into standard is seriously limited in comparison to other loans. Instance, the financial institution is not permitted to carry out a private foreclosure; the household collateral financing foreclosure have to be purchased of the a courtroom. Furthermore, the brand new https://paydayloancolorado.net/rockvale/ debtor does not have any private liability, for example while the borrower can get treat your house in foreclosure the financial institution gets no right to sue the debtor for cash.