A personal bank loan is going to be a strong economic unit getting doing your goals. Utilized intelligently, a consumer loan shall be a powerful way to create higher requests, save money and also enhance your credit rating.

However, very first, it is very important know exactly how a consumer loan work and you will how you can operate it to your virtue.

1. Crisis Medical Expenditures

We don’t need to remember medical problems, but injuries and you can conditions can happen. Of course they do, this is usually after you minimum anticipate they. If you are a medical insurance policy is extremely important, it can be reassuring to find out that you can take out a consumer loan to aid pay off medical obligations, high deductibles and away-of-system charge.

dos. Do-it-yourself

On the Countries, repairing the roof or fixing up termite destroy will be good normal element of maintaining your domestic in good shape. And you may contemplate how much more useful and you will fun your house was for many who upgraded and you can modernized two from its bedroom, for instance the kitchen area or even the bathroom. Taking out an unsecured consumer loan can be a simple, obtainable cure for purchase your residence, improving its well worth and you will increasing your guarantee. And you will, if you’re on a schedule, taking accepted for a loan are going to be reduced than other options eg household guarantee credit lines, mortgage refinances or home guarantee loans (even in the event these types of financing are tax-deductible).

step three. Debt consolidation

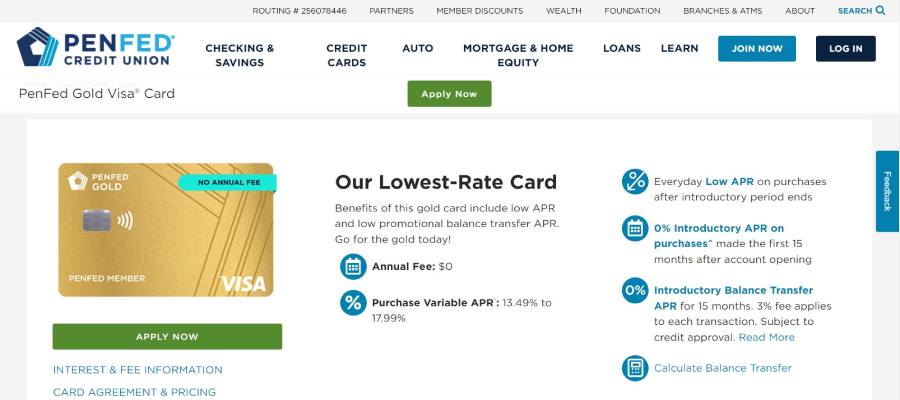

An unsecured loan usually has lower interest rates than a cards cards, and if you are carrying an ongoing bank card balance, you could more than likely spend less by taking out a consumer loan and you can paying the handmade cards. Possible reduce the amount of appeal you borrowed, have the convenience of one monthly payment and most likely pay off your overall debt in the a shorter period of time (Consider those individuals notices you see on your charge card report indicating how long it would sample pay off your debts while making precisely the minimal expected fee.).

cuatro. Replace your Credit history

Your credit rating will be based upon a range of responsible currency habits, including purchasing your own expenses timely, keeping finance and credit lines more years regarding some time using only an element of the borrowing from the bank that you qualify for. Taking right out a consumer loan shall be an easy way to boost all those practices, helping to create a very good credit score and you will improve your borrowing get.

5. High Commands

If you wish to build an enormous get including an effective auto otherwise couch, a personal bank loan can help you break it down into faster payments over time. It is beneficial since the prices can be more in balance together with rates of interest more than likely lower than if you’d utilized a great bank card to the purchase. And you can, of course, possible take advantage of the goods now, unlike waiting up until you’ve saved up adequate currency.

Almost every other Methods for Playing with A consumer loan

- Remember, later or overlooked repayments can also be lower fico scores. Automating money monthly might help make you stay on track. If you’re unable to shell out your own expenses on time, think additional options.

- Look meticulously from the charge which may be in the personal financing, including later commission charges, see operating charges, non-enough funds (NSF) charges https://simplycashadvance.net/loans/law-school-loans/ and you will yearly charges before generally making any conclusion.

- You could reduce signature loans smaller and you can reduce attention by simply making more frequent money otherwise and come up with big money when you get a plus otherwise taxation refund. However, make sure your loan words usually do not become a prepayment punishment, that ding you if you reduce the borrowed funds also easily.

- Contrast brand new annual percentage rate (APR) of your own loan when you shop around. The newest Annual percentage rate ought to include the pace and particular fees.