To better understand where home loan cost ‘re going, it’s always best to look back. The following is the guide to home loan costs of the year regarding United states

- Mortgage pricing by the year: where we’re today

- Exactly what have home loan prices become usually?

- Perform mortgage cost go down during the a depression?

- Mortgage pricing by seasons: closing opinion

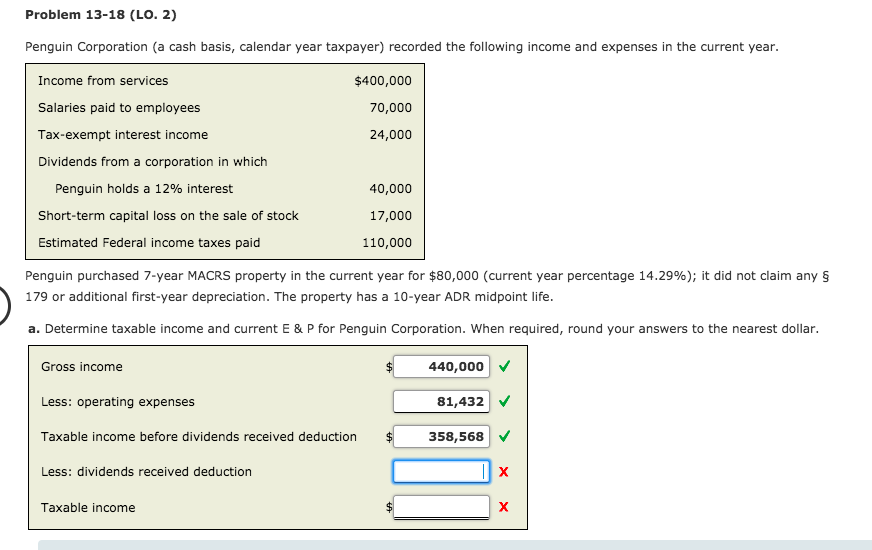

This new Federal Set aside embarked into the a purpose so you can suppress rising cost of living from inside the . From the time, mortgage prices have increased on accurate documentation speed. The average 30-seasons fixed rates initiated in the past seasons was at merely step three.22% during the January, based on Freddie Mac computer. Because of the October, the interest rate was eight.08%.

But exactly how does one mortgage rate compare with historical cost? What are particular secret schedules to understand? And you will would home loan rates go down inside a recession? Here’s your publication into the financial cost because of the seasons in the U . s ..

Financial cost by year: where the audience is today

When you look at the COVID-19 pandemic into the 2020 and 2021, mortgage rates dropped to help you record lows. Brand new Federal Reserve’s emergency step assisted to-drive home loan rates less than 3%, where they remained. All of this altered for the 2022, although not, when inflation ballooned and you may mortgage pricing increased on their high levels as 2002.

Actually, the typical 31-12 months rate ran off 3.22% into seven.08% in October, according to Freddie Mac computer. After that, in the first half a year off 2023, the average 29-season repaired mortgage speed hovered anywhere between six% and eight%.

By July, mortgage prices began stabilization. Having rising prices and progressing from, industry experts aspire to pick home loan prices check out 2024. However, there is certainly some argument in the in the event it might possibly be a significant drop off.

Exactly what provides home loan prices come historically?

Home loan prices are presently over twice its most of the-big date lowest away from 2.65%, which was reached inside the . Yet not, deciding on mortgage pricing in emergency same day loan bad credit the us across the a lot of time-identity, we will see they will always be below the historic average.

Freddie Mac computer, the leading source for financial pricing in the us, first first started keeping info when you look at the 1971. Between after that now, the latest 30-12 months fixed-rate mortgage mediocre are seven.74%. The greatest rates for similar sort of home loan are % within the 1981, followed by its 2nd highest shape regarding % within the 1982.

Financial costs because of the year: key schedules

Predicated on Freddy Mac computer info going back 1971, the typical mortgage rate is just under 8%. not, home loan cost normally vary notably from the 12 months. Specific decades, one fluctuation is far more dramatic as opposed to others.

1981

The beginning of brand new eighties spotted brand new terrible 12 months getting financial rates of interest at this point. The typical home loan rate within the 1981 was %. Precisely how bad did it get for homebuyers? At a level away from %, a mortgage costing $two hundred,000 would have a payment per month costs-for principal and you will attention-of $dos,800. The fresh much time-term average mortgage price out-of seven.74%, meanwhile, perform equal $step 1,3 hundred four weeks.

Certain People in the us in fact paid back a high home loan speed one season. This new month from October 9, 1981 watched home loan prices average %-the large mortgage rates into record.

2008

This was the past season of your financial meltdown. Centered on Freddie Mac computer, mortgage loans from inside the 2008 was readily available for six.03%. Leaving out tax and you can insurance coverage, new month-to-month rates to own an effective $200,000 financial try $1,two hundred. Just after 2008, home loan costs began a reliable decline.

2016

Up until 2021, 2016 saw the every-time reasonable home loan speed in the us. The typical mortgage into the 2016 is costing step 3.65%, predicated on Freddie Mac computer. Meaning a home loan regarding $two hundred,000 had a monthly rates, to own prominent and interest, from $915. That’s more than $five-hundred quicker monthly versus a lot of time-name mediocre.