Home ownership was an objective for many Us citizens. And the https://www.speedycashloan.net/loans/second-chance-payday-loans/ freedom and you may balances that include having a house, property owners will enjoy perfect taxation pros and you will other individuals smoother knowing the monthly payments are getting on strengthening collateral as opposed to getting discarded on the lease. This type of and other benefits are some of the reasons of several experts favor to find otherwise build a home, therefore the Virtual assistant home loan program was created to assist them to get to their mission.

What is actually a beneficial Virtual assistant financial?

In the place of traditional financing, Virtual assistant finance make it pros to get a mortgage loan and get a property without having to measure some of the greatest difficulties out-of home buying-plus coming up with a down-payment. Brand new money are given from the personal lenders, like financial institutions and you will financial people, but insured by the You.S. Authorities. This means that, lenders can offer more favorable terms but nevertheless getting safe into the circumstances the brand new debtor defaults on mortgage.

So what can an effective Va financial be used to own?

Virtual assistant home loans are often used to purchase a home, townhouse or condominium; fix otherwise adjust a property private occupancy; or build yet another domestic. You don’t need to get a primary-big date homebuyer, therefore the work for is reusable. Virtual assistant finance also are assumable, definition other buyer can take more your own mortgage loan and maintain current rate of interest and you may terms and conditions. This is not the actual situation on greater part of traditional financing.

Four larger benefits associated with Virtual assistant lenders:

- Zero down payment. This is possibly the most significant advantage having pros, lots of who experienced nothing possibility to booked one big offers or build-up its credit score.

- A lot more autonomy and leniency. That have Va money, lenders are more inclined to neglect down credit scores too once the early in the day foreclosure otherwise bankruptcies.

- No personal home loan insurance (PMI). Very old-fashioned home loans wanted month-to-month PMI money unless the buyer may come up with about 20% off at the time of income. This is simply not the case which have Va finance.

- Competitive rates of interest. Rates for Va mortgage brokers are about 0.5% to a single% less than men and women of the old-fashioned home loans-that will soon add up to tall deals over the years.

- Cover towards settlement costs. And an effective work with getting veterans, the brand new Va hats what lenders may charge and lets vendors in order to afford the settlement costs completely. That isn’t necessary, and so the buyer nevertheless is generally guilty of a few of the settlement costs (and the serious fee), although number required is oftentimes significantly less.

Whats the initial step of having a great Va financial?

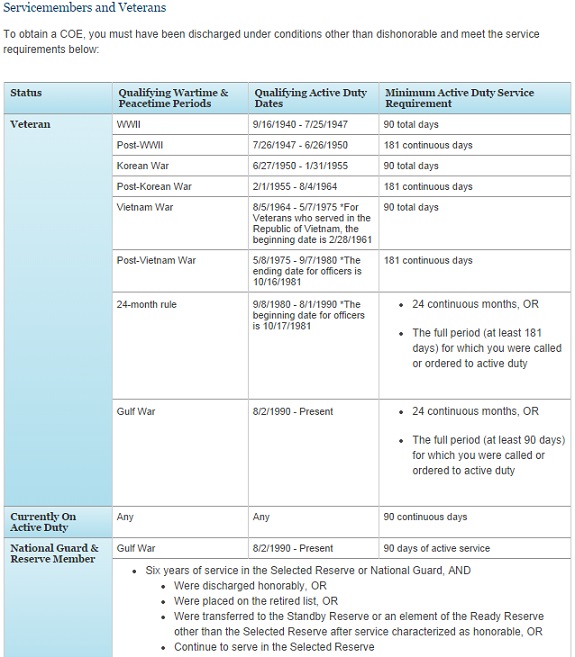

Interested veterans, services members and you may eligible partners is determine whether or otherwise not it qualify for a good Va financial by visiting brand new You.S. Agencies out of Experts Activities qualification webpage. Should your credit history and you may earnings match the brand new standards, the next phase is bringing a legitimate certification away from qualification, or COE.

Getting pros, acquiring an excellent COE form you should first have a copy from their DD214 indicating particularly the type away from provider while the narrative cause for breakup-factors 24 and twenty eight on the function. After you’ve a duplicate of one’s COE, you can submit an application for your own Va financial on line, through your financial or because of the mail.

Cannot allow finest home slip out as you do not features your own DD214.

Before you even start selecting a home, factors to consider you may have a duplicate of your DD214 in order to get good COE. In the event your DD214 never arrived, or if perhaps it had been destroyed, taken otherwise forgotten, DD214Direct makes it possible to get the means in less time-and often during the a fraction of the price of our very own opposition.

Its potential that you have called the new Federal Archives currently in order to to get your own function 100% free the help of its eVetRecs program. This can be ideal for pros who can be able to get their some time come in no rush to invest in a property. (As they discovered cuatro,100000 to help you 5,000 demands every single day, brand new Federal Archives requests that pros dont also you will need to follow up on their request up to about 90 days provides passed.)

However, when you have been your research to the primary household and you can want to make yes you have got all your ducks in the a line, call DD214Direct at step 1-888-997-4962 or submit all of our online order means. All of our knowledgeable group works actually that have archival researchers locate the armed forces discharge records reduced in accordance with less delays and you can stress. And you may rather than the federal government, you can expect current email address delivery to help make the process even much easier.