Designs and Technology

Offerings including the short pre-recognition processes-obtainable in as little as three minutes-program its dedication to leverage technical for your convenience, making it easier on the best way to safer your perfect domestic https://paydayloanalabama.com/ballplay/ in the place of too many delays.

Chase Financial

Immediately following careful consideration of mortgage lenders, Chase Bank stands out for the flexible advance payment choice and you will a strong variety of home loan factors tailored to meet your needs.

Financial from America’s sources date back over 2 hundred decades, position it as one of several state’s premier monetary institutionsmitted to empowering users, Pursue Financial even offers imaginative banking possibilities close to complete home loan qualities tailored to assist you for the recognizing your homeownership goals.

Financial Products and services

The financial institution will bring a wide variety of financial options, and additionally antique fund, FHA loans, Virtual assistant finance, in addition to their exclusive DreaMaker mortgage that needs as low as step three% downpayment. Pursue has the benefit of homebuyer gives all the way to $eight,five-hundred having eligible consumers.

This type of alternative significantly lowers your 1st can cost you, helping you to spend some fund towards the almost every other essential property expenditures. Although not, keep in mind that you’ll want to see specific money standards to qualify for the merchandise.

Aggressive Rates

The financial institution offers competitive interest rates, that can differ considering situations just like your credit history and the sort of mortgage you choose. Getting existing customers, discover a chance for a speeds cures, so it’s far more good for your.

An additional benefit at the office with Chase is the dedication to bringing a transparent home loan techniques, and that not simply makes it possible to learn their cost better as well as leads to even more told conclusion throughout your domestic-to acquire travel.

Economic Health and Balance

On top of the diverse offerings, Chase Lender includes a robust monetary updates, providing depend on within their balances on financial field. This reliability is vital regarding a lengthy-title financial commitment, eg home financing.

As well as, its thorough information, plus online assistance and you can academic content, empower one browse the fresh tend to complex home loan landscaping easily. Which supporting environment makes a hefty difference while you are and come up with impactful financial behavior related to your property.

Ally Household

All mortgage lenders try to explain the house-to get procedure, however, Ally Family stands out by eliminating financial costs totally. This innovative online financial seller is actually serious about getting a sleek and you will customer-amicable experience, allowing you to work at in search of your dream domestic without the load out of even more will cost you.

Business Records

Which have a partnership to delivering obtainable economic features, Ally Home features came up just like the a reliable financial on United Says. In the first place part of GMAC, the firm transitioned to a digital financial system, offering various financial points designed in order to meet diverse customers need.

Unique Attempting to sell Propositions

Without financial charge, Friend Family also offers an appealing offer to have homeowners, saving you significantly when you look at the mortgage process. Furthermore, the lender lets aggressive deposit choice, which have as little as step three% necessary for the HomeReady financing system, ensuring that to invest in property stays within reach.

Background records searches demonstrate that Ally Home’s no-percentage model is particularly very theraputic for budget-mindful customers who would like to end unnecessary can cost you. On top of that, by providing a HomeReady mortgage, Friend caters to lowest- to mid-earnings customers, allowing you to go into the housing marketplace which have better financial independence.

Online and Cellular Sense

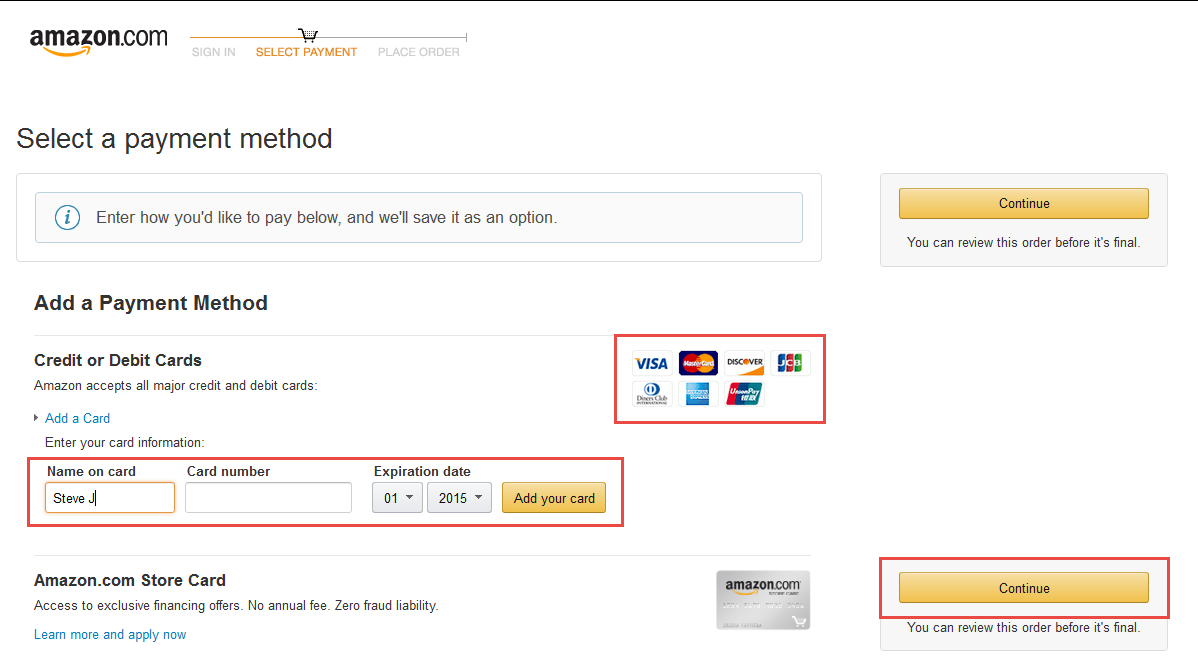

On the web networks was crucial in today’s credit landscaping, and you can Ally Home provides a robust electronic experience. The lender brings an effective on the web software process, allowing you to safer pre-recognition in as little as three full minutes, deciding to make the home financing excursion small and you will quick.