Among these, restricted funds play a crucial role in ensuring that specific donor intentions are honored and resources are allocated appropriately. There are times when funds are received in one year and carry over to the next fiscal year before they are spent; it is important to note that deferred revenue should not be recorded in these situations. If your organization only raised unrestricted funds, budgeting for the year would be much less complex. You could allocate all of your nonprofit’s funds exactly where you deemed them most important, whether that was to overhead expenses or to your latest programs.

Restricted Fund Management for Nonprofit Organizations

These funds must be used for designated purposes or within a certain period, as specified by the donor. For instance, a donor might contribute to a nonprofit with the stipulation that the money be used for a particular project, such as building a new community center, and within a set timeframe, like two years. Once the conditions are met or the time period has elapsed, these funds can be reclassified as unrestricted. Proper tracking and documentation are essential to ensure that the organization adheres to the donor’s wishes and maintains transparency. Effective management of a nonprofit’s financial resources hinges on the meticulous development and monitoring of budgets. This encompasses distinct approaches for both restricted and unrestricted funds.

Examples of Restricted Cash

In this situation, the nonprofit will be focused on how to make the best use of the funds before the time frame ends. They should also have this deadline marked prominently as a part of their grant management process. Having consistent processes in place to navigate budgets aids in both making the most out of the funds available and aiding with financial transparency. The fundraising and accounting teams should be on the same page about what needs must be funded before entering into restriction conversations with funders. The FASB requires that you set up at least 2 different “funds” within your accounts– one to track assets with donor-imposed restrictions, and one to track assets without donor-imposed restrictions.

Only Donors Can Restrict Funds

Unlike unrestricted funds, which the organization can use freely for any purpose, restricted funds must adhere to the donor’s specific conditions. Unrestricted funds often make up the majority of donations for small nonprofits. So you can use this money for any organizational need that aligns with your legally declared mission. The funds cannot be redirected to other purposes, even if the budget picture becomes bleak.

Adhering to these standards not only ensures accuracy but also enhances the credibility of the organization. Are you navigating the complexities of fund accounting in QuickBooks and finding it challenging to track restricted funds accurately? Many nonprofits face these obstacles, which can hinder financial restricted funds on balance sheet transparency and donor trust. FastFund Nonprofit Accounting is crafted to address these specific challenges, streamlining your accounting processes and ensuring meticulous tracking of your funds. The management of restricted funds is not just a matter of organizational policy but also of legal compliance.

What is Restricted Cash?

If a donor gives a donation with a designation that doesn’t make sense for the organization at that time, it can always ask the donor if the money can be used for other purposes. Most donors are trying to help the organization, and such a request is usually granted. Rarely, a donor may have a personal agenda, or is seeking some type of influence, and is not willing to lift the designation. At this point, the nonprofit can accept the donation and agree to the restriction, or it can refuse the gift altogether.

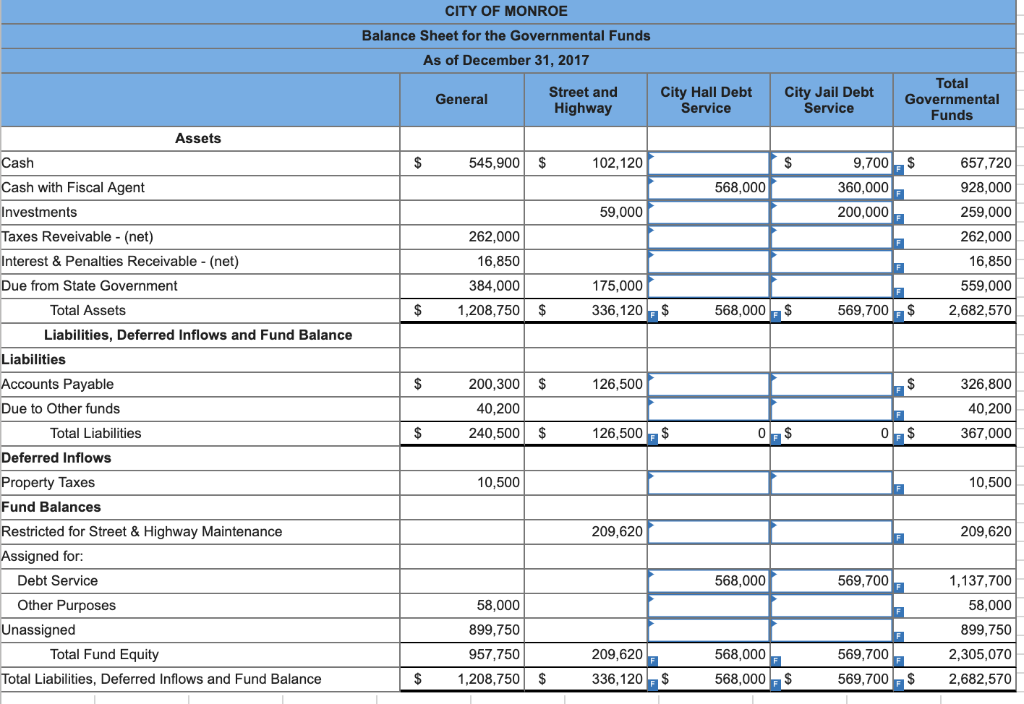

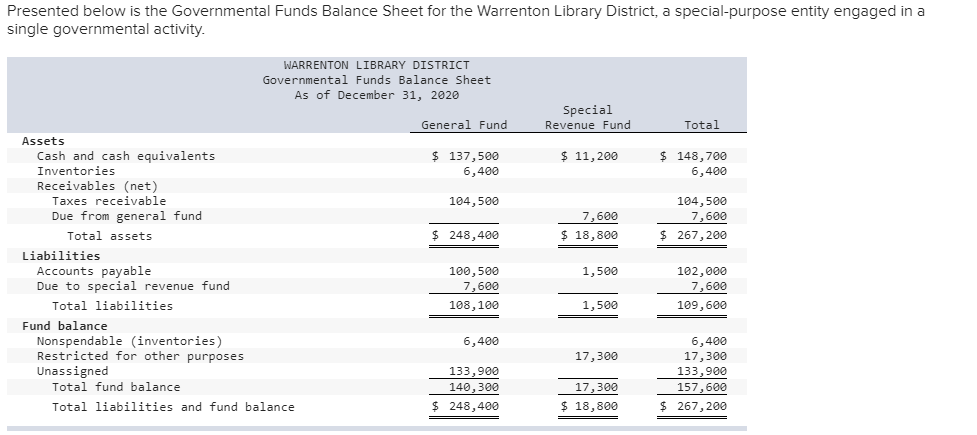

Recent research conducted by GASB shows a lack of consistency among governments in reporting the components of fund balance and that the components are often misunderstood by financial statement users. It is often unclear if any of the reserved or designated fund balances are available to help balance a government’s budget. Essentially, restricted funds have specific purposes and cannot be co-mingled with other funds.

In the FAN example, the total column for 2018 total income shows the full $60,000 multi-year grant and reports a surplus of $40,325. For practical purposes, only $20,000 could be used to support the program during this year. The “Without Donor Restrictions” column is the most valuable tool for monitoring the current year financial activities.

Implementing robust internal controls, such as segregation of duties and regular financial audits, can safeguard against misuse of funds. These controls not only protect the organization but also build trust with donors, demonstrating a commitment to transparency and accountability. This format also delineates funds with restrictions from funds without donor restrictions. By focusing on net assets without restrictions, organizations are given the most accurate and relevant picture of the net assets available for use. For analysis, planning, and decision-making, it is important for an organization to understand what part of their net asset position is without restriction. It is very important to keep documentation of the donor restrictions and to track these restrictions either in the general ledger or other software, such as Microsoft Excel.

- Second, income must be recognized, or recorded in the accounting records, in the year that an unconditional commitment for the funds is received, regardless of when the related expenses will occur.

- The primary, and possibly most important reason, for complying with requirements for restricted funds is trust.

- Among these, restricted funds play a crucial role in ensuring that specific donor intentions are honored and resources are allocated appropriately.

- We understand the importance of accurate fund management in your mission-driven work.

This reflects the satisfaction of the restriction, allowing the funds to be used for general purposes. Nonprofits most often need balance sheets when filing annual taxes, applying for grants, and appealing to major donors. It’s also an excellent tool to keep board members informed about the financial status of your organization. Nonprofits should include balance sheets in their organization’s annual reports and when filing Form 990 with the IRS. Your balance sheet will split assets by current assets, fixed assets, and others.