Every time cash, checks, money orders, or postal orders (or anything else) are deposited in the bank, the cash book (bank column) is debited. That’s to say, an entry is made in the bank column on the debit side of the cash book. The two column cash ledger book is sometimes referred to as the double column cash book or the 2 column cash book. Let us understand the format of maintaining a petty cash book or a detailed cash book through the detailed explanation below. To maintain an accurate cash book, it’s important to record all transactions as soon as they occur and to ensure that each transaction is entered into the appropriate column.

Types of Bookkeeping Accounts Used To Organize Income and Expenses

A cash book is a chronological financial record of all the cash transactions of a business involving cash receipts and cash disbursements. As explained earlier in this article, only the cash and bank columns of the triple-column cash book what is meant by nonoperating revenues and gains work as accounts and are therefore balanced. The discount columns on both receipt and payment sides are only totaled and not balanced. In the general ledger, two separate accounts are maintained for discount allowed and discount received.

What is a bank statement?

In the present modern world, almost all transactions done are using the company’s bank account. So, it was required to present one more column to the single-column cash book. Under double-column cash books, cash transactions and transactions through banks done by the business are also recorded. A double column cash book is similar to a single column cash book, but it has two columns instead of one.

Triple Column Cash Book

A small business owner once shared how an oversight during their busy season resulted in lost revenue due to poor documentation keeping practices resulting in under-declared sales for tax purposes. Once a small cosmetics store in downtown Chicago found an excellent way to increase its profit by offering discounts on cash purchases, resulting in a significant increase in their earnings. Do not compromise financial stability; hence it would be in your best interest to keep up with your regular records’ balancing. This way, you’ll have a better idea on how to keep accurate financial records.

This receipt is called a debit voucher because it supports the entries on the debit side of the cash book. For every entry recorded in the cash book, there must be a proper voucher. Irrespective of the number of sub-divisions, each page of the cash book can have a number of formats from single column to multi-column.

- A folio number is a unique number assigned to a specific ledger account mentioned in the description column for easy reference and cross-verification.

- Each incoming cash transaction must have supporting documents to back up the amount recorded in the Cash Book.

- Despite being difficult to maintain on a large scale, organizations ensure maintaining cash book accounting for a handful of reasons.

- All items on the credit side of the cash book are posted to the debit of respective accounts in the ledger.

At the end of each month, when the petty cashier approaches the main cashier for reimbursement, the latter will prepare a cheque voucher. Utility companies typically have high capital requirements, meaning free cash flow may be low or inconsistent due to ongoing reinvestment needs. Residual income valuation can capture the economic profit generated after meeting equity costs without relying solely on cash flows. By focusing on book value and earnings, the model helps analysts assess whether the utility’s investments are generating returns above the required rate, even in the face of heavy capital spending.

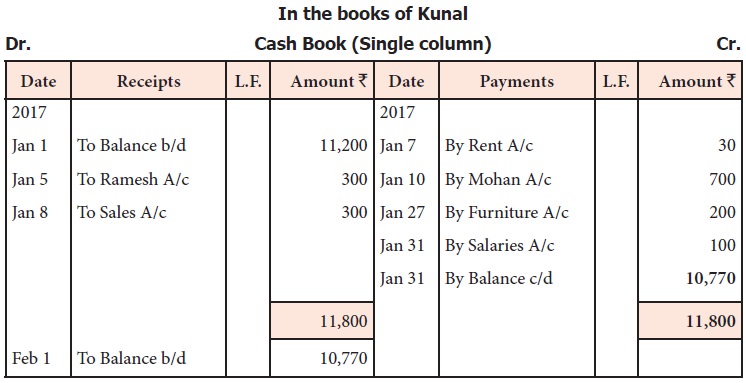

Harper Company uses a single-column cash book to record all cash transactions. It engaged in the following cash transactions during the month of September 2016. Consequently, this cash book has given rise to the concept of contra entries, commonly denoted as ‘C’ in the cash book. Contra entries are made when transactions occur between a cash and a bank account, for instance, cash withdrawn from a bank account for business investment. At the end of the accounting period, the difference between the debit and credit sides is computed.

To illustrate, for a company receiving cash payment for sales, entries will be made both in the sales ledger and the cash book. The three column cashbook uses three columns on each side of the book. This format in effect combines both two column formats discussed above in that it uses the additional columns to record both discounts and bank account transactions. As before the first three columns in the diagram are the date, transaction description (Desc.), and ledger folio reference (LF). A cash book with three columns for discounts received and paid, cash transactions, and bank transactions is known as a three column cash book.