As well as the particular financing your get, think about the details of the borrowed funds

- Devices book. Not in lieu of rental a vehicle, equipment accommodations spread out the price of a major devices buy more than a-flat length of time. Very lessors don’t need an enormous down-payment on the a lease, and when new book keeps work on the direction, you could choose to often go back the device or spend the money for rest of the equipment’s worthy of based on the longevity of brand new rent together with prefer of your own product involved. Even though the monthly installments might be less than the new initial costs away from merely to get a bit of equipment, you should note that attention can add on toward rate level.

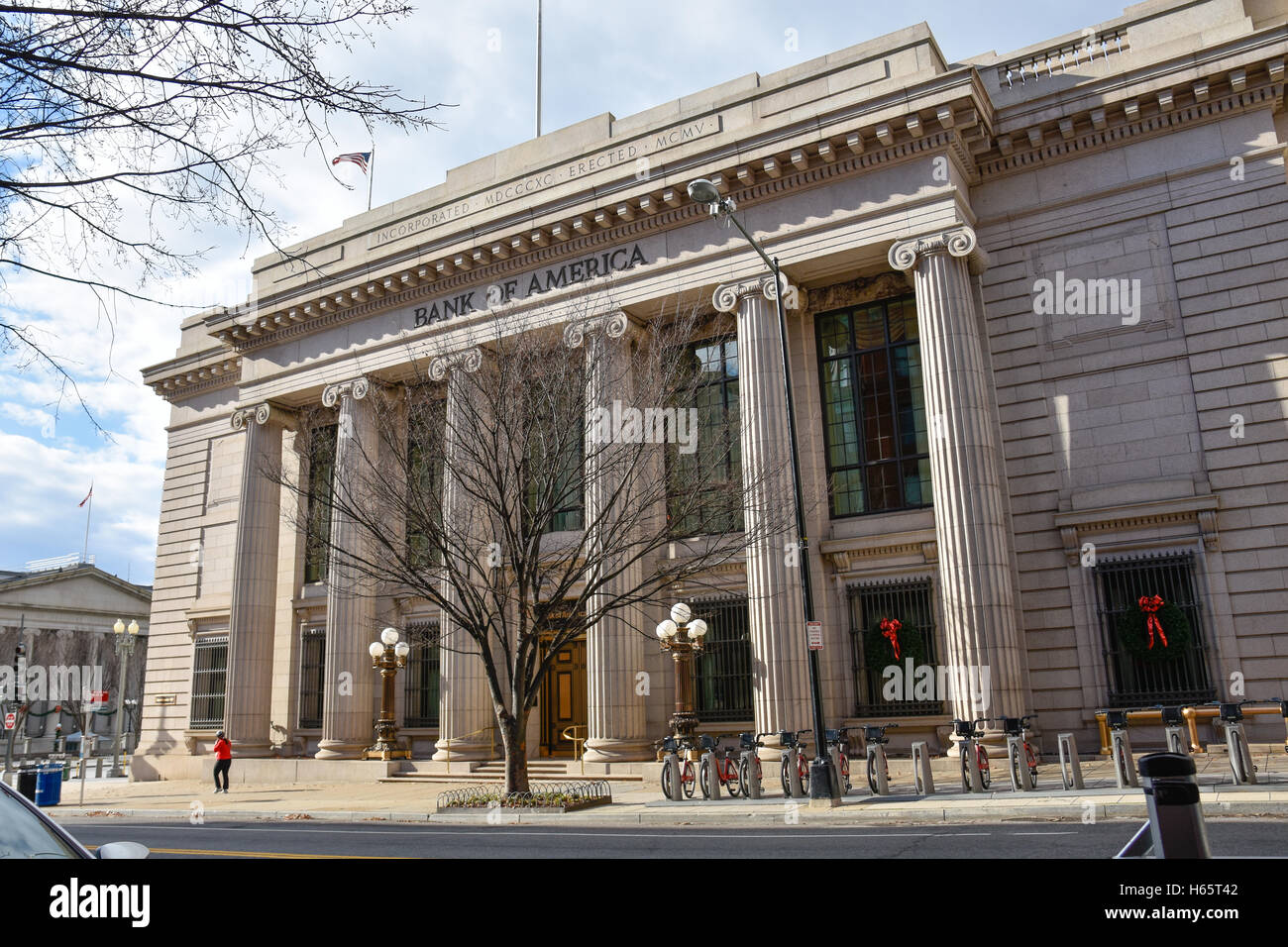

- Page from borrowing. A page out-of borrowing try a vow out-of a bank you to a supplier gets the correct commission owed timely. The newest be certain that is available in a couple additional types: vendor safety otherwise customer coverage. On previous, the financial institution agrees to pay owner in case your consumer fails and come up with the payments that’s basically provided for worldwide purchases. Financing for it kind of page are often compiled in the visitors initial into the a kind of escrow. Visitors defense is out there in the way of a punishment so you’re able to the vendor, such as a reimbursement. Banking institutions render these emails to help you companies that make an application for one to and have the credit score or collateral requisite.

- Unsecured company financing. An unsecured team mortgage has no need for the new debtor to add any guarantee resistant to the number these include borrowing from the bank. Given that its friendlier to your borrower than the lender, the lender charges a substantially higher rate of interest than just it could for a loan supported by equity. This financing try most commonly provided thanks to an online financial or any other solution lenders, even though conventional banks was basically recognized to bring unsecured loans so you’re able to customers which have an existing relationship with the college. Without having any guarantees when it comes to security, unsecured business loans are often more difficult to acquire than other money. The newest intrinsic risk doing work in a personal bank loan definitely means they will normally be offered once the an initial-title loan to ease this new lender’s chance.

Options so you can bank loans

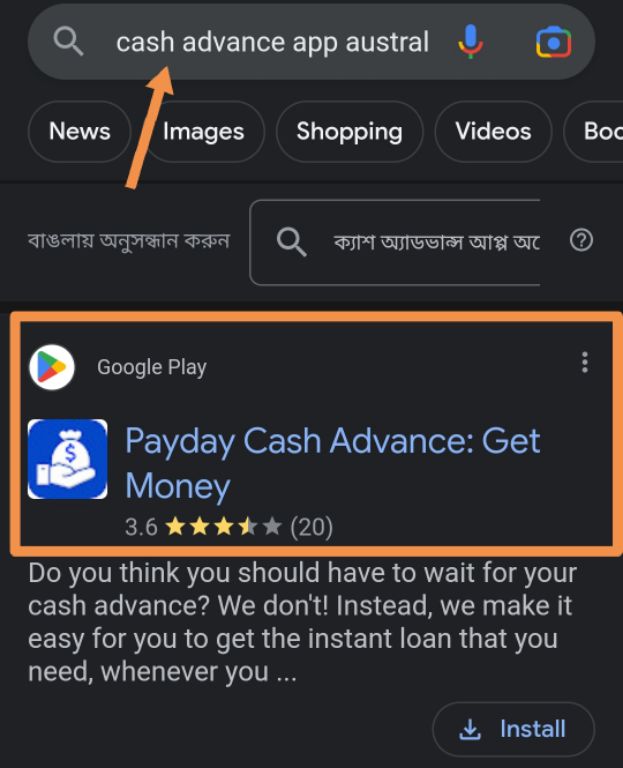

Loans from banks aren’t your sole option. You could work on choice loan providers to help you hold the investment your you want. Option loan providers are a substitute for believe whether your company cannot be eligible for a vintage mortgage. Listed here are several alternative financial loans to look at:

Besides the version of loan your apply for, consider the specifics of the mortgage

- Online fund: On the web lenders are normally so much more versatile having loan certification, therefore the turnaround date is smaller, but the pricing could be more than conventional money. Lendio is but one for example on line lender. americash loans Pickensville You can submit an application as a consequence of its safe screen.

- Microloans:Microloans give a little bit of money to help you cover particular will cost you inside your providers. Microloans normally have a somewhat low interest rate. The disadvantages regarding microloans is a shorter time physical stature to spend back the mortgage, and lots of loan providers want your funds from this new microloan getting used on certain expenditures such as for instance gadgets sales.

Per loan boasts a unique rate of interest and you may financing label, among most other circumstances regarding said which might be given that incredibly important since the sort of financing you are taking towards the. It is essential to read the offer entirely to make sure around aren’t undetectable terms and conditions otherwise charge.

Rates: As well as the sum of money you want to acquire, the loan rate otherwise known as the speed is an activity you positively need determine. Loan cost disagree according to research by the kind of mortgage you’re seeking, the bank you’re borrowing from the bank the money out-of plus personal borrowing from the bank rating, on top of other things. Whenever searching for a corporate mortgage, you prefer that that have a low interest, when possible. According to the types of mortgage, you may look for cost assortment from step three% as much as 80% apr.